capital gains tax canada vs us

Multiply 5000 by the tax rate listed according to your annual income minus any selling costs. Long-Term Capital Gains Taxes.

Capital Gains Tax Canada Makes This The Cheapest Tax You Ll Ever Pay

And the tax rate depends on your income.

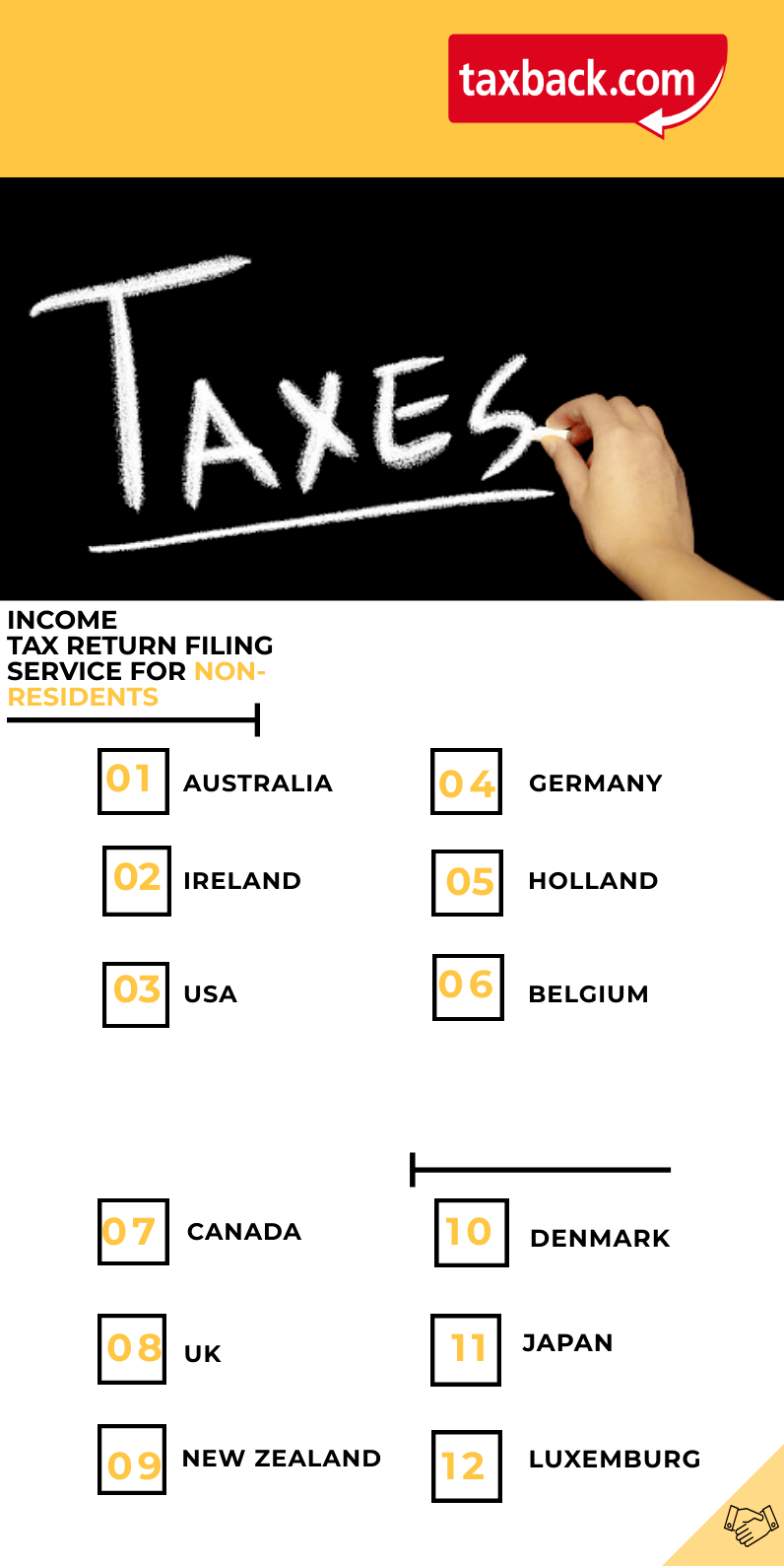

. In Canada the taxable capital gain must be reported as income on your tax return for the year the asset was sold. When it comes down to it the tax rates. 2 File Your Canadian Tax Return.

Your sale price 3950- your ACB 13002650. On a capital gain of 50000 for instance only half of that amount 25000 is taxable. Federal income tax on the net total of all their capital gainsThe tax rate depends on both the investors tax bracket and.

Comparing the Canada corporate tax rate to the USA is like comparing apples to oranges in many aspects. For example if you sold an. In the United States of America individuals and corporations pay US.

However that is irrelevant for the. The sale price minus your ACB is the capital gain that youll need to pay tax on. For a Canadian who falls in a 33 marginal.

Since its more than your ACB you have a capital gain. If you earned a capital gain of 10000 on an investment 5000 of that is taxable. Canada Corporate Tax Rate vs USA.

Dollars is US2500. Estates in Canada For Canadian purposes a Canadian resident is deemed. In contrast under US taw law there is an exemption of US250000 US500000 if.

Here is are following tax scenario and offset possibilities. If you bought a cottage for 200000 and now sell it for 500000 you will receive. Notwithstanding paragraph 1 the taxes existing on March 17 1995 to which the Convention shall apply are.

Sale 10 1800 18000. The income is considered 50 of the capital gain. Under Canadian tax law a principal residence is exempt from capital gains tax when it is sold.

Property must also be included on your. Although not directly calculated in the image above the capital gain for this transaction expressed in US. And youll be selling the 10-ounce gold at 1800 per ounce in 2025.

As a Canadian resident you are subject to tax on your worldwide income. Because you only include one-half of the capital gains from these properties in your taxable income your cumulative capital gains deduction is 446109 half of 892218. Cost basis 101500 15000.

Long-term capital gains are taxed at lower rates than ordinary income and how much you owe depends on your annual taxable income. Any gains or losses from the sale of US. And Canada have considerably different systems of taxation related to the estates of deceased persons.

When you buy a home you must pay tax on its fair market value at the time of purchase. A in the case of Canada the taxes imposed by the Government of Canada.

Understanding The Three Types Of Income Four Pillar Freedom

Market Weekly Update 4 26 2021

Biden Capital Gains Tax Rate Would Be Highest In Oecd

Capital Gains Tax What Is It When Do You Pay It

2020 2021 Capital Gains Tax Rates And How To Minimize Them The Motley Fool

The Tax Break Down Preferential Rates On Capital Gains Committee For A Responsible Federal Budget

Capital Gains Tax In Canada And The U S Tax 101 Youtube

How Are Dividends Taxed 2022 Dividend Tax Rates The Motley Fool

Northern Trust Wealth Management Asset Management Asset Servicing

Understanding Taxes And Your Investments

The Us Tax Code Punishes Entrepreneurship Foundation For Economic Education

Declaring Foreign Income In Canada

Tax Tips 2016 Investment Income Capital Gains And Losses Capital Gains Tax Canada

How Do Taxes Affect Income Inequality Tax Policy Center

Tax Implications For U S Investors Owning Canadian Stocks

Why Cranking Up Taxes On Capital Gains And Dividends Is A Real Clunker Of An Idea American Enterprise Institute Aei